Condominium ownership combines personal ownership with shared responsibility. While condos often offer lower maintenance and access to shared amenities, they also create unique insurance challenges that many owners don’t fully understand until a loss occurs.

Condo insurance exists to protect what the association does not. It safeguards your personal property, interior unit features, liability exposure, and financial investment when unexpected events happen. Understanding how condo insurance works—and how it interacts with your HOA’s master policy—is essential for avoiding costly coverage gaps.

This guide explains condo insurance in practical terms, outlines what it covers, clarifies common misconceptions, and helps you decide how much insurance your condo truly needs.

What Is Condo Insurance?

Condo insurance, commonly referred to as an HO-6 insurance policy, is designed specifically for condominium unit owners. Unlike standard homeowners insurance, condo insurance does not protect the entire building. Instead, it focuses on the areas and risks that belong solely to the individual unit owner.

A typical condo insurance policy provides coverage for:

-

Interior structural elements of the unit

-

Personal belongings

-

Personal liability

Search more topics

Explore related answers and trending queries in seconds.

-

Additional living expenses if the unit becomes uninhabitable

Because condo ownership involves shared walls, common areas, and an association-managed structure, condo insurance works together with — not instead of — the HOA’s building insurance.

How Condo Insurance Works with the HOA Master Policy

Every condominium association carries a master insurance policy, but the scope of this coverage varies widely. Understanding the association’s policy is critical, as it determines where your personal responsibility begins.

Common HOA master policy types include:

-

Bare walls coverage, which insures only the building structure

-

Single-entity coverage, which includes original fixtures

-

All-in coverage, which extends to fixtures and built-in features

Anything not covered by the HOA policy becomes the unit owner’s responsibility. Condo insurance fills these gaps, covering interior elements such as flooring, cabinetry, countertops, and interior walls, as well as personal property and liability.

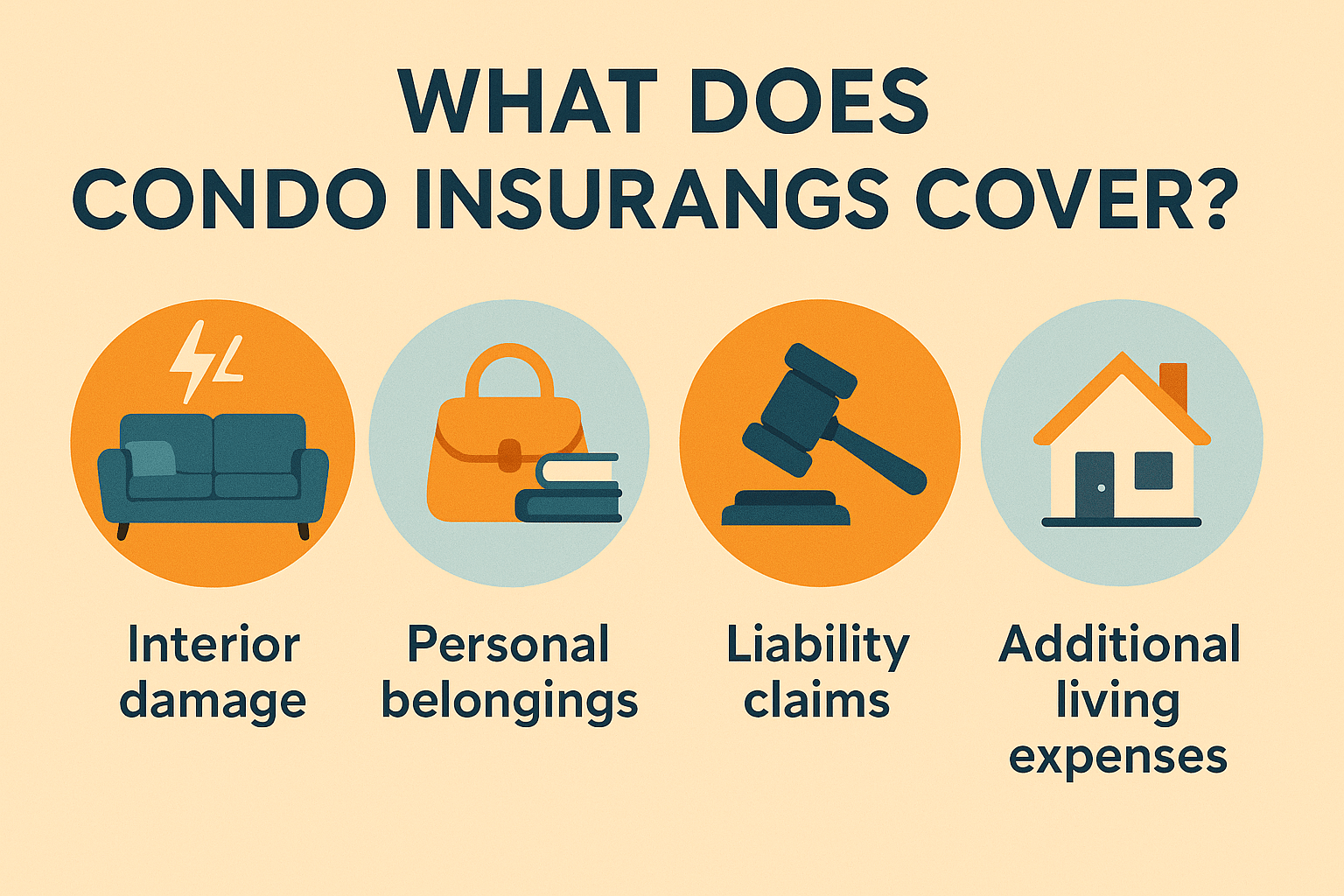

What Condo Insurance Covers

Interior Dwelling Coverage

Interior dwelling coverage applies to the parts of the condo unit you are responsible for repairing or replacing. This often includes:

-

Interior walls and ceilings

-

Flooring

-

Built-in appliances

-

Bathroom and kitchen fixtures

-

Upgrades and renovations

Owners who have customized or upgraded their unit should ensure coverage reflects the current replacement cost, not the original construction value.

Personal Property Coverage

Personal property coverage protects belongings inside the condo against covered risks such as fire, theft, smoke damage, vandalism, and certain water-related incidents.

Items typically covered include:

-

Furniture

-

Electronics

-

Clothing

-

Appliances

-

Personal items

Most condo owners require between $20,000 and $70,000 in personal property coverage, depending on lifestyle and possessions.

Personal Liability Coverage

Personal liability insurance protects condo owners if they are legally responsible for injury to others or damage to their property. This includes incidents that occur inside the unit and, in some cases, incidents involving the owner elsewhere.

Liability coverage can help pay for:

-

Medical expenses

-

Legal defense costs

-

Court judgments or settlements

Standard policies usually include $100,000 in liability coverage, though higher limits are often recommended for added protection.

Loss of Use Coverage

If a covered event forces you to temporarily move out of your condo, loss of use coverage helps pay for:

-

Hotel stays

-

Temporary rentals

-

Increased food costs

-

Essential living expenses during repairs

This coverage helps maintain financial stability during unexpected disruptions.

Condo Insurance vs. Homeowners Insurance

Condo insurance is not the same as traditional homeowners insurance.

Homeowners insurance typically covers:

-

The entire structure

-

Roofs and exterior walls

-

Land and detached structures

Condo insurance focuses on:

-

Interior unit components

-

Personal belongings

-

Personal liability

-

Gaps left by the HOA policy

Because condo owners do not own the entire building, their insurance needs are more specialized and depend heavily on association rules and responsibilities.

Do Condo Owners Need Building Insurance?

In most cases, no. The condo association carries building insurance for the structure and common areas. However, relying solely on the HOA’s coverage can leave owners financially exposed.

If the master policy provides limited coverage, owners may be responsible for repairing significant interior damage themselves. Reviewing the association’s insurance documents is essential to avoid surprises during a claim.

What Is Condo Rental Insurance?

Condo rental insurance applies when a condo unit is used as a rental property.

If you own and rent out your condo, you typically need landlord-style condo coverage rather than standard owner-occupied insurance. This can include protection for:

-

Interior structure

-

Liability arising from tenants

-

Loss of rental income

If you rent a condo as a tenant, renters insurance — not condo insurance — is appropriate.

Choosing the correct policy type is critical, as insurers may deny claims if the unit’s use is misclassified.

Why Condo Insurance Can Be Expensive

Condo insurance costs vary significantly, and some owners are surprised by higher-than-expected premiums. Common pricing factors include:

-

Building age and construction materials

-

Location and natural disaster risk

-

Claims history of the association

-

Replacement costs of interior features

-

Coverage limits and deductible amounts

Units with luxury finishes or located in high-density buildings may require higher premiums due to increased repair and liability risks.

How Much Condo Insurance Coverage Do You Need?

Choosing the right coverage starts with understanding your financial exposure.

Personal Property Coverage

Most owners need enough coverage to replace all personal belongings at today’s prices, not what they paid years ago.

Interior Dwelling Coverage

Coverage should reflect the rebuild cost of interior finishes, including upgrades and renovations.

Liability Coverage

While $100,000 is common, many owners opt for $300,000 or higher to protect assets and income.

Deductibles

Higher deductibles reduce premiums but increase out-of-pocket costs during a claim. Balance affordability with protection.

Condo Insurance and Common Claims

Condo insurance frequently applies to claims involving:

Water damage from neighboring units

Fire and smoke damage

Theft or vandalism

Liability claims from guest injuries

When losses occur, the HOA policy typically applies first for shared areas, followed by the unit owner’s condo insurance for interior and personal losses.

Is Condo Insurance Worth It?

For most condo owners, the answer is yes. Condo insurance provides targeted protection that complements association coverage and prevents major financial setbacks.

Without it, owners may face:

Expensive interior repairs

Legal liability costs

Loss of personal property

Temporary displacement expenses

Considering the value of the protection relative to cost, condo insurance is a practical and often essential safeguard.

Final Thoughts: Condo Insurance Protects More Than Property

Condo insurance is not just about meeting requirements—it’s about protecting your home, financial security, and peace of mind. By understanding how coverage works and choosing limits that reflect real risks, condo owners can confidently navigate shared living without unnecessary exposure.

About The Author

Search Anything

Search any topic — insurance, loans, travel, technology, health, and more.